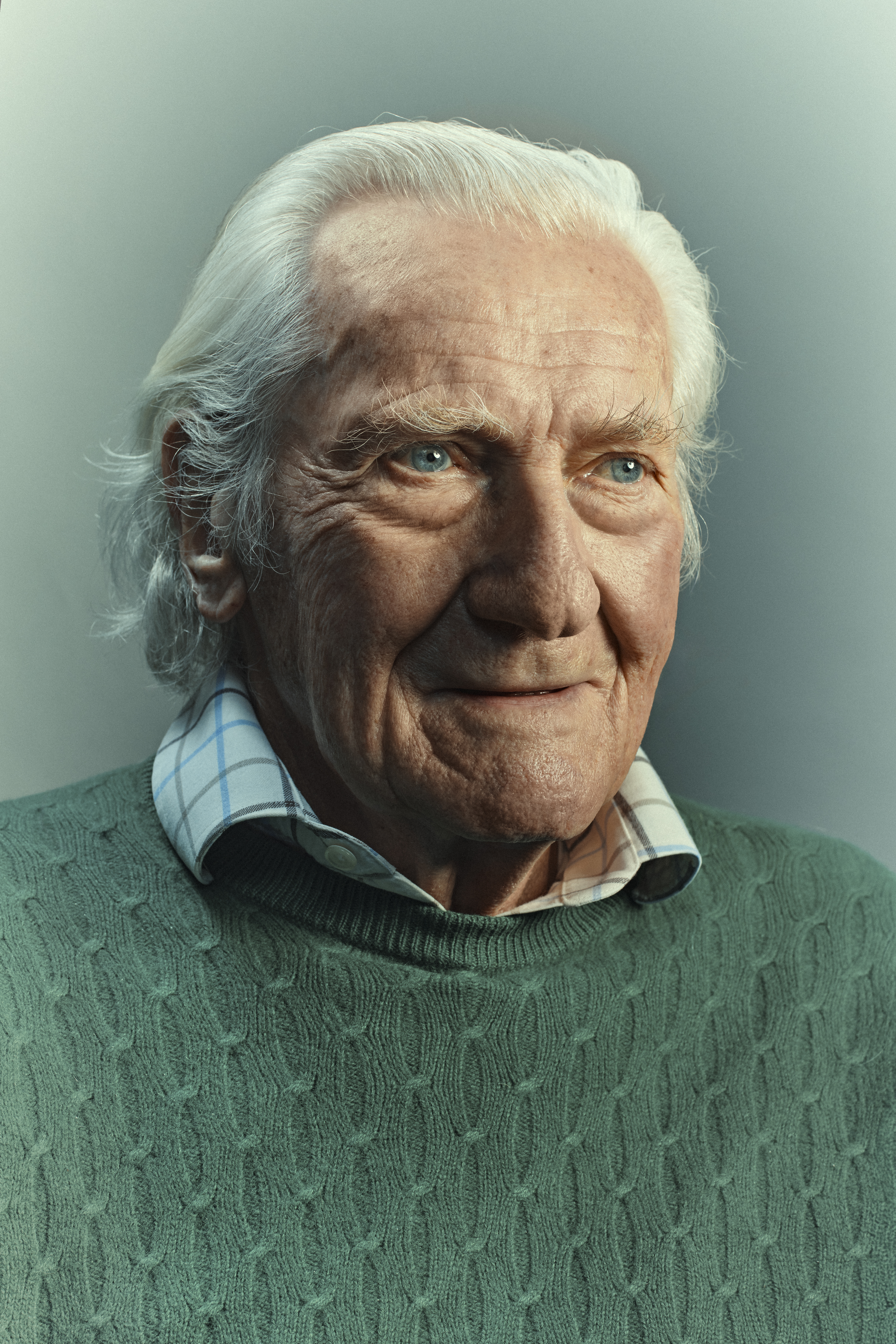

Lord Heseltine Reveals His Personal Weaknesses: Jaguars and Jelly Babies

Lord Heseltine, a prominent figure in the Conservative governments led by Margaret Thatcher and John Major, transitioned from a property developer to a publisher. He co-founded the Haymarket Media Group in 1957 and stepped down as chairman in 2023.

At 91 years old, he was a Conservative MP from 1966 to 2001, fulfilling the roles of secretary of state for the environment on two occasions, as well as secretary of state for defence and trade and industry. His tenure as deputy prime minister lasted from 1995 to 1997.

He and his wife, Anne, have three adult children and split their time between their home in Thenford, Northamptonshire, and a flat in London.

About £100 — I noticed this during lunch. I typically use cash for “unpredictables” and for the occasional taxi fare.

What credit cards do you use?

I primarily utilize my debit card, as it provides clarity in spending.

Do you consider yourself a saver or a spender?

I am a saver by nature. I have always been involved in building ventures, whether it’s businesses like Haymarket or my gardens and arboretum at Thenford, requiring capital to create. My most recent significant purchase was an antique tripod stand by Ince and Mayhew, which I gifted to my wife.

Do you own real estate?

Yes, our primary residence is Thenford House, an 18th-century estate in Northamptonshire, purchased for under £500,000 in 1976. Over the last 50 years, we have turned the surrounding 70 acres from a neglected area into Thenford Gardens and Arboretum, featuring a collection of uniquely designed gardens. Currently, one of the property’s outer walls is being repaired to correct its lean, a more economical option than rebuilding. We also own a leasehold flat in Belgravia.

Are you financially better off than your parents?

Yes. I have one sibling. My father was the director of a structural steel firm in South Wales, and my mother hailed from a family of local business owners, so I grew up in a middle-class neighborhood in Swansea. I take pride in my Welsh heritage and serve as the patron of the Morriston Orpheus Choir; hearing “We’ll Keep a Welcome” often brings me to tears.

What was your earnings last year?

That information is publicly available.

What was your first job?

I was articled to Peat, Marwick & Mitchell, which later merged to become KPMG, earning £7 a week, while many of my peers made £13. I started in their London office in January 1955, suitably dressed, and was immediately dispatched to audit accounts for a slaughterhouse.

When did you first feel affluent?

I have enjoyed a decent standard of living since relocating to London in the mid-1950s. However, the volatility of business left me aware of potential downturns, and it’s only in recent years that I’ve felt financially secure. Ironically, I miss the daily challenges of managing a business.

For the first time, I am now concerned about sustaining Haymarket’s private ownership due to the recent tax measures introduced by Labour. The burden of inheritance tax imposed by Rachel Reeves raises critical questions about how family-owned businesses like Haymarket can manage.

This tax is a danger to small family businesses, essential for the British economy, and it appears the Labour government fails to understand its consequences.

Have you ever struggled financially?

In the early 2000s, I faced significant financial challenges while working to buy out my partners at Haymarket, where I owned just over half of the company, during a period of £140 million debt. By selling some assets, we resolved this issue, and my son Rupert now chairs the company, which is thriving.

What has been your most profitable venture?

Launching Haymarket, which has grown to have international operations in multiple countries like the US, Germany, Hong Kong, and India.

Do you invest in stocks?

In 1955, I audited the accounts for Marks & Spencer and subsequently bought £500 in shares. Those shares are now valued at about £30,000, which is a solid return.

What do you believe is better for retirement — real estate or pension?

While I receive state, parliamentary, and ministerial pensions, I do not plan to retire fully. If one enjoys their work and maintains their faculties, why stop?

What has been your wisest business decision?

Going into business with my friend Ian Josephs, using our inherited £1,000 to purchase the lease of a boarding house, the Thurston Court Hotel, in Notting Hill in 1955. This turned out to be tremendously successful, allowing us to sell it a year later and double our investment, which set the stage for future successes.

What about your best investment?

Procurement of the medical business AE Morgan, which created a reference guide for the medical community, for £250,000 in 1965. Our American branch, which now comprises a substantial portion of Haymarket’s revenue, originated from this initial investment. Additionally, our efforts in developing the arboretum at Thenford have brought us immense satisfaction and financial returns as well.

What has been your worst investment?

Buying Topic, a weekly magazine intended to rival Time and Newsweek, for £10,000 in 1962. Unfortunately, we failed to attract sufficient advertising and had to close it shortly after launching.

What is your financial weakness?

I have consistently purchased Jaguar cars since acquiring my first second-hand model for £1,250 in 1956. My current vehicle is a Jaguar XJ V6 Portfolio, and I believe Jaguar Land Rover has a bright future ahead. Additionally, I have a fondness for jelly babies.

What has been your most extravagant purchase?

The £4,000 golf buggy I acquired in 1992 after my heart attack, which helps me navigate our gardens and arboretum. We have also traveled frequently, viewing that as a form of extravagance. A memorable trip organized by Max Hastings was to the Galapagos Islands with notable individuals like Ken Clarke and Douglas Hurd. A standout moment was observing the unique blue-footed booby bird. Our next adventure is planned for the Scilly Isles.

What are your financial priorities for the future?

To mitigate the harsh impacts of the inheritance tax introduced by the current government. I am also hopeful for a reversal of Brexit, which, based on misleading premises, has been detrimental to business.

If you won the lottery jackpot, what would you do?

I do not play the lottery as I am not a gambler. However, if I were to win, I would consider donating to Oxford University and the Oxford Union, as I owe them a great deal.

What important lesson about money have you learned?

The necessity of preserving funds and the importance of timing and luck in financial success.

Post Comment